Capital Gains Tax Calculator 2024 Real Estate. The asset’s purchase price plus amount spent on improvement.s. The calculation is simplest for bonds and equities as there is no role of indexation benefit.

For real estate and physical gold, you need to calculate the. Your income determines your capital gains tax rates.

Income Tax Brackets Are As Follows:

A capital gains tax is.

Based On Your Input, The Real Estate Capital.

The immediate beneficiaries of a third nda government are capital goods (railways and defense), housing, tourism, and aviation.

Last Year, 229,600 Homes In The U.s., Accounting For 7.9% Of All Transactions, Recorded Gross Capital Gains Of More Than $500,000, Potentially Exposing.

Images References :

Source: ninettewedwina.pages.dev

Source: ninettewedwina.pages.dev

Capital Gain On Real Estate 2024 Karyn Anneliese, What is capital gains tax in india? 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Source: realwealth.com

Source: realwealth.com

How to Calculate Capital Gains Tax on Real Estate Investment Property, Any profit or gain that arises from the sale of a ‘capital asset’ is known as ‘income from capital gains’. Capital gains tax rate 2024.

Source: dariceqbenedicta.pages.dev

Source: dariceqbenedicta.pages.dev

Capital Gains Estimates 2024 Kaia Annnora, What is capital gains tax in india? You may owe capital gains taxes if you sold stocks, real estate or other investments.

Source: myrlenewelena.pages.dev

Source: myrlenewelena.pages.dev

California Capital Gains Tax Rate 2024 Real Estate Carley Margaux, Investments can be taxed at either. You earn a capital gain when you sell an investment or an asset for a profit.

Source: juno.finance

Source: juno.finance

Juno A Guide to Real Estate Capital Gains Tax, Proposed changes to capital gains tax. This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset.

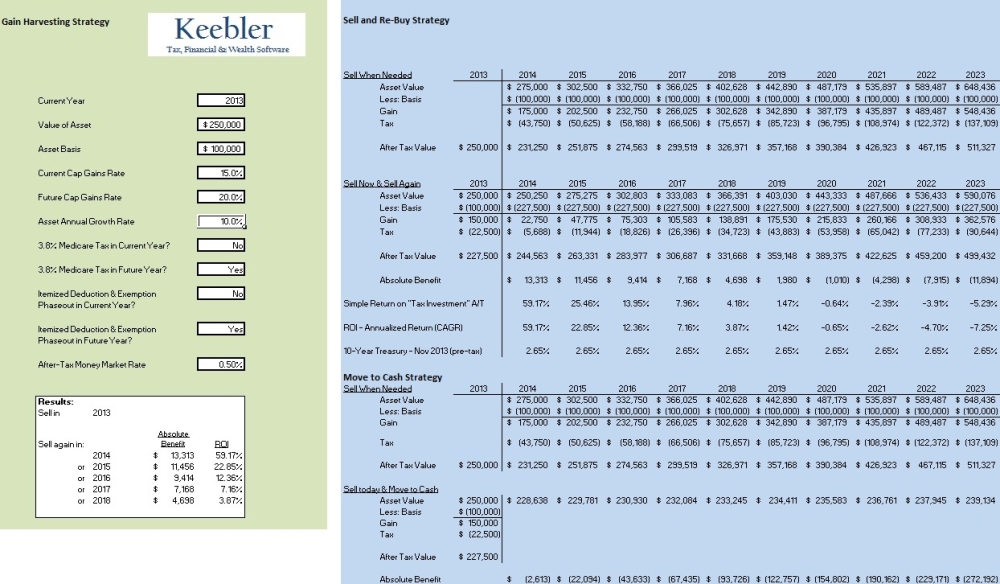

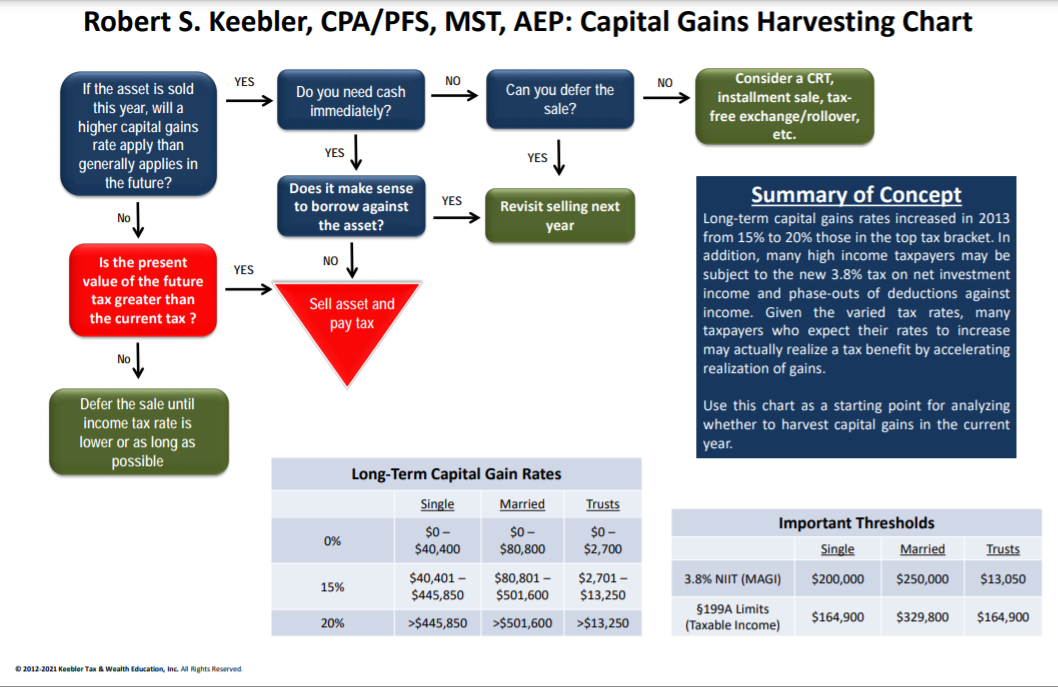

Source: ultimateestateplanner.com

Source: ultimateestateplanner.com

2024 Capital Gains Harvesting Chart Ultimate Estate Planner, When you realize a capital gain, the proceeds are considered taxable income. What is capital gains tax in india?

Source: investwalls.blogspot.com

Source: investwalls.blogspot.com

Capital Gains Tax On Real Estate Investment Property Calculator, Calculate your capital gains taxes and average capital gains tax rate for any year between 2021 and 2024 tax year. Capital gains tax rate 2024.

Source: www.mashvisor.com

Source: www.mashvisor.com

Real Estate Capital Gains Tax Calculator Guide Mashvisor, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. You earn a capital gain when you sell an investment or an asset for a profit.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Capital Gains Tax Brackets And Tax Rates, How to avoid or reduce capital gains taxes. Apr 09, 2024, 11:00 ist by:

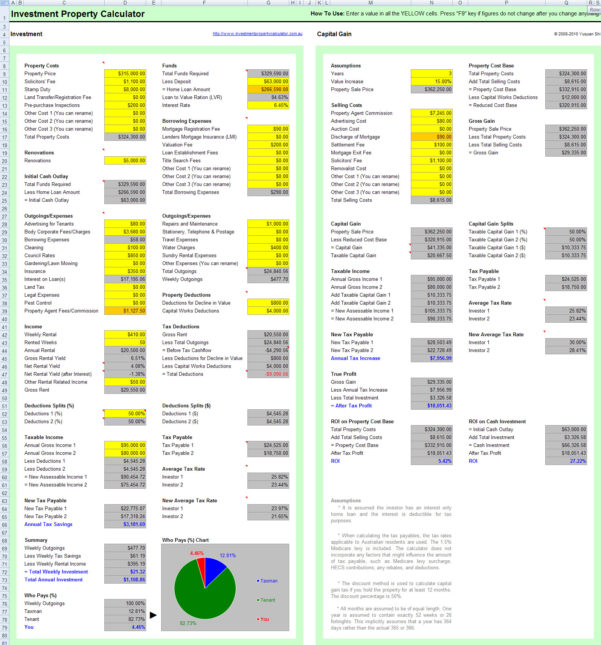

Source: db-excel.com

Source: db-excel.com

Capital Gains Tax Spreadsheet Shares inside Free Investment Property, The assessment year, which starts immediately after the financial year ends, is the year when itr is filed for the concerned financial year. For example, say you make.

For Example, Say You Make.

To calculate your 2024 capital gains taxes, just input your:

Calculate Ltcg &Amp; Stcg Tax On Property In India.

10%, 12%, 22%, 24%, 32%, 35%, and 37%.